Because were the optimum and fair public revenue stream being collected, there would be no requirement for schemes to help governments struggling with deficits.

Economists Professor Roger Sandilands and Fred Harrison point out that Economic Rent (often disguised as interest/profit) accounts for about half the UK gross income.

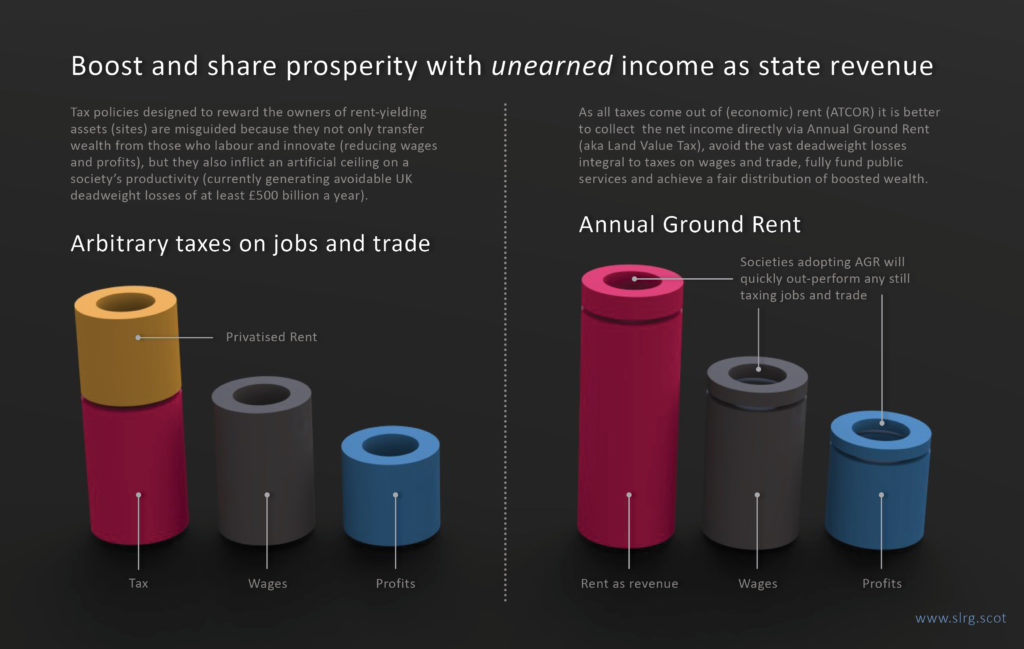

Current taxes collect about one third. And non-contributing parasites extract one fifth (the yellow zone in our diagram).

This net income is the rent of land and natural resources which Adam Smith and the classical economists said was the optimum source of state revenue.

Collecting this stream of wealth would be both fair and efficient: At least £500 billion a year of UK deadweight losses (Scotland at least £38bn) would be avoided. This is the lower estimate of the production absent in the UK each year for as long as we continue to tax wages and trade.

As we can see from the diagram, the public purse would double in a very short time.

Apart from the obvious implications for public service funding and embedded UK inequality, the Westminster and Scottish governments would no longer require any scheme devised to help governments in deficit. Nor would the citizens of any country making the change require such schemes; all their needs would be met out of the collected funds they all help collectively to produce.

Rather, as Adam Smith pointed out, were the rents of land and natural resources to again be directed back to the community that generated them, they might be as well of after the levy as before.

What then for industry, investment and today’s fragile communities? Let Henry George himself answer:

And that wealth would be shared.