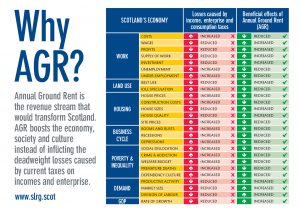

Taxes repress activities to which they are applied. The repressive effects of tax are called the deadweight losses of taxation or the excess burden of taxation. This means that taxes are good tools for reducing smoking or pollution; but bad for jobs, homes, productivity, enterprise, investment or progress of any kind. These articles show how taxes like Income Taxes and VAT repress economic activity by at least £1 for each £1 of tax raised. Replacing arbitrary ‘deadweight taxes’ with AGR cancels all such losses because revenue raised on site rental values cannot reduce the area of land available.