When owners collect site rents they collect the surplus of society as unearned income. This is because after wages and profits are allocated, all that is left over as surplus is absorbed as rent. But site rental values are public value. Annual Ground Rent should be collected to fully fund public services, avoid the vast ‘deadweight losses’ of taxation and equalise life chances by sharing society’s surplus amongst all who together generate that surplus.

That returning to site rent as revenue is the route to a boosted and shared Scottish prosperity is confirmed not only by the great Scottish Enlightenment thinker, Adam Smith, but also by Nobel laureate professors of economics who advise the Scottish government today:

“ …it is highly efficient to tax rents because such taxes don’t cause any distortions… A stiff tax on all such rents would not only reduce inequality but also reduce incentives to engage in the kind of rent-seeking activities that distort our economy and our democracy.”

The Price of Inequality (2012) pp 212-213.

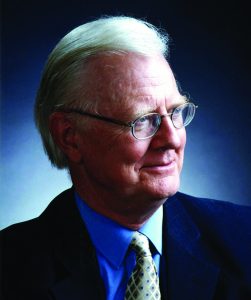

Professor Joseph Stiglitz

PROFESSOR OF ECONOMICS COLUMBIA UNIVERSITY, FORMER CHIEF ECONOMIST AT THE WORLD BANK, NOBEL PRIZE WINNER, MEMBER OF SCOTLAND’S COUNCIL OF ECONOMIC ADVISERS

“ …taxing land itself… is equivalent to taxing an economic rent – to do so does not discourage any desirable activity… [It] would also capture the benefits accruing to landowners from external developments rather than their own efforts.”

Tax by design (2011) Ch 16, p 371.

Professor Sir James Mirrlees

EMERITUS PROFESSOR OF POLITICAL ECONOMY UNIVERSITY OF CAMBRIDGE, NOBEL PRIZE WINNER, MEMBER OF SCOTLAND’S COUNCIL OF ECONOMIC ADVISERS

“ …no discouragement will thereby be given to any sort of industry. The… wealth and revenue of the great body of the people, might be the same after such a tax as before. Ground rents…are, therefore, perhaps, the species of revenue which can best bear to have a peculiar tax imposed upon them.”

The Wealth of Nations (1776) Book V, p 370.

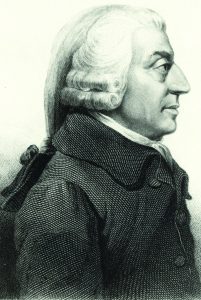

Adam Smith

SCOTTISH ENLIGHTENMENT PHILOSOPHER, THE FATHER OF MODERN ECONOMICS