Annual Ground Rent.

The market rental value of each site is assessed and collected to fund public services. Demand for the free services of nature and the amenities provided by society determine site rental values — the actual sum we are prepared to pay to occupy a site in an open market. In countries collecting AGR, damaging taxes on employment and enterprise can be reduced or scrapped so that the massive ‘deadweight losses’ of taxation that cripple economies like Scotland’s can be avoided altogether.

AGR is also known as Land Value Tax. We use ‘Annual Ground Rent’ to better describe its benign and highly progressive characteristics (as described by Adam Smith). Unlike other ‘taxes’ AGR does not raise revenue from (and thus reduce) any productive work or enterprise. It is the stream of value generated by all of us working together.

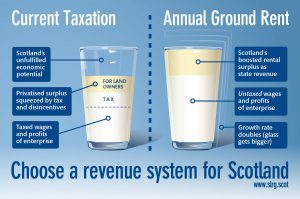

The performance of AGR is described by Roger Sandilands, Emeritus Professor of Economics at Strathclyde, in this infographic in which the empty part of the glass to the left represents Scotland’s unfulfilled economic potential and the cream on top of the milk the economic surplus of society.