Rather than place our hope in the EU or the UK, Scotland should choose a future in which the socially produced surplus is shared with its producers – and demonstrate to the world what can be achieved.

Calling a halt to social exclusion and unequal life chances which today characterise the EU and the UK, Scotland could be different.

In zones such as Hong Kong and Singapore, low taxes on wages and trade allow enterprise to thrive. Instead they collect site rents via leases. Scotland can collect site rents via a Land Value Tax, better described by Adam Smith as an (Annual) Ground Rent (AGR).

With Income Tax, National Insurance and VAT drastically reduced or zeroed, Scotland’s enterprises would thrive not only at the economic centres, but for the first time at the economic periphery. No longer would wealth production be inhibited by an artificially imposed government cap. And the sums people willingly devote to occupying sites (minus the value of improvements) would be returned to where it belongs: the currently starved Public Purse.

Yes: UK Austerity and inequality are government choices.

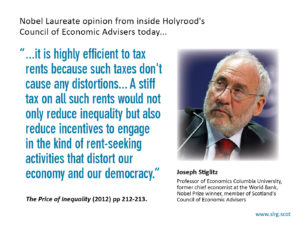

This wealth is the natural source of state revenue. A statement confirmed by at least two members of Holyrood’s retained Council of Economic Advisers: Nobel Laureates Professors Joseph Stiglitz and the late Sir James Mirrlees. Site rental values have no cost of production. They are provided free by nature or reflect exactly the investments made by society in amenities and services enjoyed by each site. The values freely placed on sites by their users represent not only an accurate cost of the services the occupier chooses to use, but also the Net Income of Scotland – the sum produced over and above wages, profits and the costs of doing business – which can be collected by government without harming enterprise or confiscating the legitimate hard-earned wages and profits of work and innovation.

In the UK the rent of land and natural resources accounts for over half the annual wealth produced (the gross income) in a voluntarily repressed economy. Current taxes collect about one third of the gross income. Our troubles have arisen when our society has negligently permitted persons to succeed in directing these Common resources away from the Public Purse into their private pockets.

The remedy is to untax earned income and tax away all unearned income.

A Scotland built on the inclusive and egalitarian rent-as-revenue model would be a society not only experiencing boosted prosperity, but that prosperity would be shared.

Currently, as a member of the UK Idea, people and resources are sucked out of Scotland by distorting tax arrangements designed at Westminster to favour site owners. People involuntarily on the move are sucked, whether they will or no, towards London and the South East.

The effects of the inherited skewed tax regime are astonishing. As site values rise in line with investment in amenities (our taxes being spent) site owners at the economic centre receive unearned wealth exceeding their tax bills.

Please read that again.

It means those of us not counted among the privileged site owners must not only supply them all with a comfortable free life, but that we must also bear the entire costs of running the state!

You really have to salute the cynical ingenuity of those landlords in historic control at Westminster for shaping the fiscal policy of Britain so far to their advantage – and for somehow, to this day, getting away with it!

But it is not just Scotland that suffers.

‘The North’ is an abandoned English zone. Most peripheral UK economic locations are the same. Neither they, nor Scots, are equal partners in the UK Idea. Nor have they been since its inception. Within the skewed tax regime projects like HS2, far from being tools to share prosperity, are unmasked as schemes to facilitate further ‘Rentseeking’ by ensuring the continued flow of servants into the economic centre (London) so that site rental values there are not threatened by shortages. And remember – the full net costs are to be borne by those not owning the prime London sites.

Now Scotland can be different, leading Scots into a future of boosted and shared prosperity. And if Scotland acts, you can be sure that The North will be queuing at the door, eager to join the Scottish Idea.The UK and Europe too, when they see what can be achieved.

Even with devolved powers, Holyrood can make a start. By restructuring tax, Holyrood can boost economic activity in Scotland by 9% without increasing the sums collected. See our fully costed policy option, ‘Scotland’s Path to Prosperity’ at http://slrg.scot/…/uplo…/2018/02/pathtoprosperity.web_-1.pdf

The ‘free lunch’ comes in the form of cancelled ‘deadweight losses’ integral to taxes on jobs and trade.

By Ian Kirkwood