Roger Sandilands

Emeritus Professor of Economics, University of Strathclyde

Last December, finance secretary Derek Mackay admitted he had never heard of the famous Laffer Curve that points to potential loss of fiscal revenues when tax rates are increased. From this year’s budget speech it seems he is still no wiser. In particular, he seems unaware that even if a rise in tax rates does produce more revenue this can still inflict great harm. For example, a two percent rise in the rate will increase revenues if the resultant fall in GDP is “only” one percent.

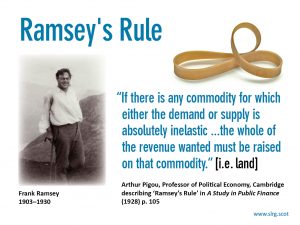

Thus, alongside the Laffer Curve, one also needs the concept of deadweight loss. This relates to an “optimal tax rule” made famous by a brilliant Cambridge economist, Frank Ramsey, in 1928. The rule is that a tax on an object or activity should minimise the elasticities of supply and demand. The rule is violated when a tax discourages work and enterprise, or distorts expenditure patterns.

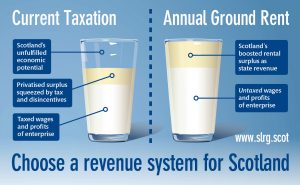

The rule applies best to land. As Adam Smith and David Ricardo famously agreed, there are no adverse supply-side effects from raising public revenue from land’s annual ground rent (AGR). This is a socially created surplus that owners enjoy and renters pay for land’s natural fertility, mineral riches, proximity to social amenities, or local job opportunities and planning consents. Market-based rent differentials cannot be eliminated by moving land from a low- to a high-rent location, or by hiding it, or by adding to its (fixed) supply. Demand for land is also highly inelastic. Deadweight losses from taxation are therefore near zero. In this it differs from the response to price differentials on goods and services, wages or profits where arbitrage and supply shifts apply.

Public revenue from AGR is more commonly known as land-value taxation. This is misleading. Taxes are paid by individuals regardless of any benefit the individual may obtain in return. By contrast, AGR is an annual value created by our community and enjoyed by its users. The community therefore has a strong ethical claim on it. It is not theft. No such ethical principle attaches to imposts on earned incomes.

If Derek Mackay and the SNP are serious about equity, efficiency, growth and stability they need a radical fiscal rethink.