Social unrest may be expected in the wake of C19. Not because we were hit by a disaster not of our making; but because the wilful starvation of public services, leading to poor pandemic precautions, will be repeated if there is no root and branch change to the way in which public services are funded.

Our call for the functions of state to be funded out of the rents of land and natural resources (AGR/LVT) is criticised for being too radical. How could you possibly even think of replacing income taxes?

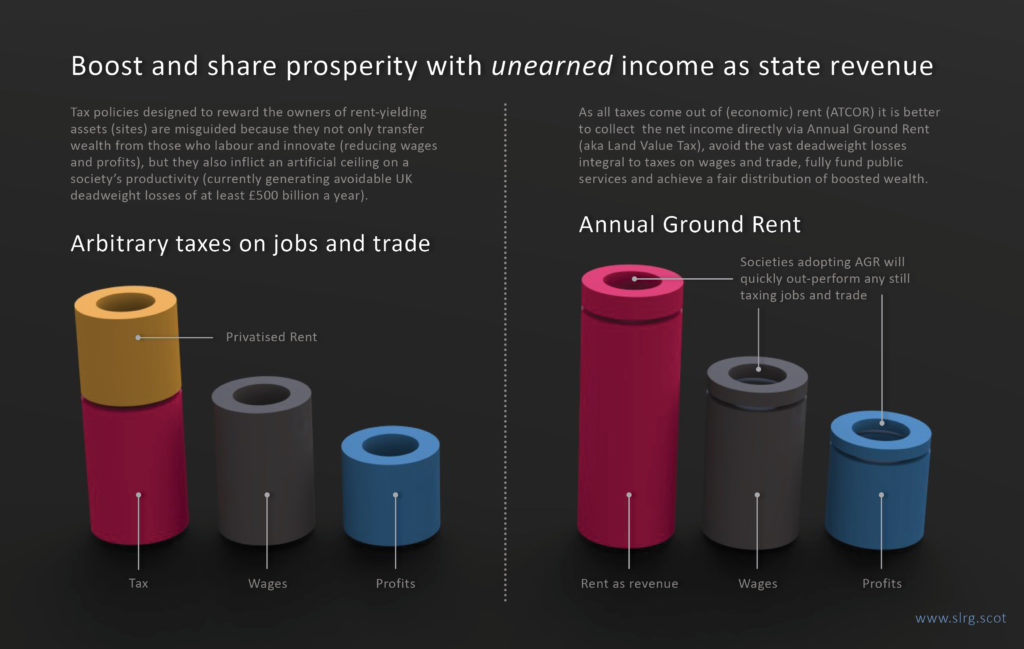

Question: What would it take for a country like Scotland to take seriously a change of revenue from taxes that repress wealth production and privilege a minority, to a levy which dismantles privilege, boosts prosperity and shares the country’s net income with all of its producers?

Answer: EVENTS.

Events such as the Coronavirus pandemic may at last focus the minds of politicians. Or the looming avoidable depression of 2028? The UK and Scotland have been hit unexpectedly by a tragedy requiring state intervention on a massive scale. MMT suggests money be produced by governments to pay for it all. But what about when the limits of credibility in the currency are reached? Money production can only go as far as a country’s real potential production.

Today Scotland has taxes on wages and on trade. The tax rates are already set as high as they can be without repressing the tax base by an unacceptable level. Production is already repressed by at least £500bn/yr (UK). But more money is needed to make good the anticipated government Coronavirus spending.

Austerity will not be acceptable and if forced will produce social unrest. What is the way then for current unfortunate events to be faced up, challenged and pushed aside?

It is time for Holyrood to take seriously the SLRG proposals to start funding government functions with AGR/LVT and to cancel as much as possible of Scotland’s wage and enterprise imposts. This will collect a significantly larger sum into Scotland’s Public purse – all from UNEARNED income – and at the same time boost and share Scottish prosperity.

Everyone will be a winner except the parasites who expect to grow rich from by extracting wealth produced by the efforts of others. Yet even they will share the opportunities to invest in new productive enterprises germinating across the new Scotland. And they will also receive their full share of newly expanded and at last properly funded Scottish public services.