The operation of the UK government tax scam, by which capital gains from high value locations rapidly offset, then overtake, the entire lifetime tax liabilities of site (home) owners, is documented in Fred Harrison’s book, Ricardo’s Law.

The unearned wealth extracted by site owners is produced by society as a whole when it invests people’s taxes in amenities.

This travesty, of course, leaves the full costs of state to be borne by others less fortunate. And explains the ‘necessity’ for government-applied Austerity.

Must Holyrood approve and perpetuate such Westminster cons? So far, the Scottish Parliament has exhibited little awareness of the culpability being transferred onto its shoulders from Westminster.

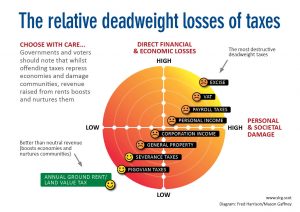

Take, for example, devolved Income Tax. Will the Scottish Government tell us how much Scotland loses each year from the deadweight losses of Income Tax, a tax it now independently champions in Scotland for the first time?

£12 billion (Harrison)? £24 billion (Feldstein)? Or even more?

AGR/LVT please (zero deadweight losses)!

https://shepheard-walwyn.co.uk/product/ricardos-law/