The concept of ATCOR: ‘All Taxes Come Out of Rent’.

Rent gains are experienced when other taxes are abated.

Professor Mason Gaffney

The meaning and relevance of ATCOR is that when we lower other taxes, the revenue base is not lost, but shifted to land rents and values, which can then yield more revenue.

This is most obvious with taxes on buildings. When we exempt buildings, and raise tax rates on the land under them, we are still taxing the same real estate; we are just taxing it in a different way. We will show that this “different way” actually raises the revenue capacity of real estate by a large factor. There is much recent historical experience with exempting buildings from the property tax, in whole or part. It has shown that builders offer more for land, and sellers demand more, when the new buildings are to be untaxed. The effect on revenue is the same as taxing prospective new buildings before they are even built, even though the new buildings are not to be taxed at all.

Land value is what the bare land would sell for. It is specifically and immediately most sensitive to taxes on new buildings, and on land sales, as well as to new and stricter building codes or zoning that often discriminate against new buildings. Lowering the income tax rate on the prospective capital gain in land sales contributes also to the marathon runup of our times in land prices.

Examples of ATCOR from experience

The writer has assembled data from the histories of New York City, Hong Kong, Taiwan, major cities in Australia and S. Africa, San Francisco after the fire, Chicago in its Progressive Era, California Irrigation Districts after the L.L. Dennett reforms of 1909, Vancouver under 8-term Mayor Edward Denison “Single-tax” Taylor, Cleveland under Mayors Tom Johnson and Newton D. Baker, Toledo under Mayors Samuel Jones and Brand Whitlock, Detroit under Mayor Hazen Pingree, Portland, OR, under the indirect influence of Wm. S. U’Ren[1], Seattle under Mayor George Cotterill, Houston under the ministrations of single-tax Assessor J.J. Pastoriza, San Diego under Assessor Harris Moody, and much of western Canada in the era of “Single-tax Taylor”[2].

In all those cases untaxing buildings while uptaxing land resulted in higher land prices. The writer has documented this in the work cited. Professor Robert Murray Haig of Columbia University documented it in his 1915 Report on The Exemption Of Improvements From Taxation In Canada And The United States[3] . Haig actually faulted the system for failing to hold down land prices, as some of its champions had erroneously hoped and promised it would, but the relevant point here is that it raised land prices, the new tax base.

New York City exempted new dwellings up to a moderate ceiling value for 10 years, 1921-31. The result?

“There has been a tremendous increase in land assessments since 1920 in all the boroughs. … The resumption of building has greatly increased the taxable value of the land, which is not included in the exemption. … Tax exemption is creating aggregate taxable values to an extent heretofore unknown in the history of any municipality.”[4], (emphasis mine).

We also observe the ATCOR principle at work in many analogous situations

– Lowering the corporate income tax rate raises stock prices

– Lowering interest rates raises real estate prices

– Commercial rents are multipartite, and a lower share of gross revenues means a higher fixed rent.

– Oil leases are multipartite, and a higher fixed royalty rate means lower bonus bids;

– Wartime taxes depress land prices, while peace dividends let them rise again. There is a long world history of peace dividends followed by land booms.

– The Resource Curse Effect: an influx of mineral revenues, obviating other taxes, leads to land booms.

– The remarkable productivity of the U.S. income tax when wages were exempt, 1916-30, and we paid for World War I with less deficit finance than any other belligerent.

– The utility-rate effect: lower rates mean higher rents and land prices, as observed in practice and explained in theory by Hotelling, Vickrey, Stiglitz, Feldstein, and others.

The Logic of ATCOR

The thesis that all taxes are shifted to landowners follows from three major premises. One, the supply of land is fixed inside every tax jurisdiction, by definition. Two, after-tax interest rates are determined by world markets, so the local supply of capital is perfectly elastic at a fixed, after-tax rate. Three, labor is also quite mobile – that is how most of our ancestors got here, and then migrated and continue to move all over North America, not to mention switching jobs in the same city. Many of the “top ten cities” of 1900 can hardly make the top 50 today, while many of today’s top ten were not even on the radar in 1900.

In Ricardo’s time much English labor was too poor to emigrate easily, but he and the English Exchequer observed that labor subsisted at so low a level that it could not bear any taxes. Taxes in the form of the corn laws that raised the price of bread were shifted to employers who had to raise wages to keep their workers alive. This is an essential link in classical political economy. Today some 30 million Americans experience hunger and malnutrition, as in Ricardo’s time. Today, though, they also have the choice of surviving on welfare, miserable though that is, again making for an elastic supply.

Keynes could assume an elastic labor supply drawn from a large pool of unemployed – his version of Marx’s “reserve army”. Thus in Keynes’ demand-side macro model higher aggregate demand makes more jobs rather than raising wage rates. This model dominated macro thought for 50 years, and keeps popping up still in the implicit models behind verbal analyses that supposed “supply-siders” deliver. The supply of “work” (as opposed to “labor,” defined as so many warm bodies) is highly elastic so long as there are unemployed. When we find work for the unemployed and underemployed, labor gains without its costing land or capital anything. Property even gains because of lower dole costs, lower crime costs, and lesser social dissatisfaction and rebelliousness. The enhanced psychic benefit of universal job security is also worth a lot. When Keynesianism was in flower, many alleged that the social cost of putting the unemployed to work is zero.

Nowadays Keynes is out of style with the dominant anti-labor schools. Unemployment was the bogey of the Great Depression era, and full employment the master goal, but times have changed. Fashionable Chicago-school patois now makes unemployment simply “leisure”, just another good one consumes like butter or shampoo, a voluntary choice, a matter of personal “taste”. And yet leading Chicagoan Gary Becker freely postulates elastic labor supplies when he routinely blames unemployment on minimum wage laws. “It’s simple”, he opines. “Hike the minimum wage, and you put people out of work”[5]. That assumes an elastic labor supply, as workers move in and out of the “reserve army of the unemployed”.

Were we to tax land more and production and consumption and capital less, real wage rates would rise, as better land use and more investing increased demand for labor and lowered product prices. This was the theme of Progress and Poverty, and the primary goal of George’s reforms. He likened the land market, beset by imperfections like speculation, to an unconscious universal cartel withholding much good land from full use, forcing labor and investors out to worse land.

That was even before we had heavy payroll and income taxes on labor. Now, it is entirely possible for banishing such taxes to let after-tax wage rates rise while before-tax wage rates don’t. There is ample “room” in the present tax system for that to be a possible outcome.

In the event, however, that real wage rates should rise enough to absorb some of the gains from tax reform, it would not lower tax revenues from land. The rise of wages in the Georgist system implies a rise of GDP. The rise would result from removing the excess burdens of current taxes, which in turn will first raise the marginal productivity of labor. That would ensue from opening the “internal frontier”. One can also view that as ending the artificial scarcity of land. This means that workers who now each add, say, $20,000 a year to GDP in menial tasks, or struggling on marginal land, would instead add $40,000 a year each. While this would redistribute income against rents, much of the increase would come from a net rise of GDP.

The net rise of GDP will raise the demand for land for residential and recreational (R&R) uses, because land for R&R is a “superior good”. That means that doubling incomes more than doubles demand for land for R&R. Adam Smith observed that in 1776; George saw it in 1879[6], and we have illustrated it above for modern times. Lowering after-tax rents will, to be sure, lower the R&R demand for land, but raising other factor shares, including rates of return on real investing, will replace the lost demand from any given GDP. The rise of GDP will more than replace it.

Even in small closed economies, there is also another kind of “reserve army”, that of capital, misallocated or underemployed. This is because the cash return is taxed, so owners park slack money in consumer capital yielding untaxed implicit income as “service flows”, and in eleemosynaries, foundations, government works, sterile personal property like yachts, “bling-bling” and arty property like precious gems and overpriced paintings, and relatively undertaxed housing. From this would spring a large supply, if all uses of capital were untaxed, because all capital is fungible each time it turns over. Here is more elasticity in the supply of capital, even in a closed economy[7]. During W.W. II civilians in the U.S.A. and other belligerents lived a massive example of how people can draw down consumer capital to meet an emergency need. For 15 years up to 1946, Americans lived in dwellings built before 1931, which simply aged without replacement.

Most modern economists observe elastic capital supply, but only in selected contexts. They write of world markets, rapid transfers, and arbitrage. But early anti-Georgists, in their zeal to protect land from taxation, left a heritage of justifying taxes on capital. When E.R.A. Seligman was bending the twig of modern tax theory, he expressed his point memorably: “There is no fund of capital floating in the air to be brought to earth by the magic touch of Mr. Henry George”[8]. Today, Chicago tax economist Arnold Harberger replicates Seligman by promoting his “new view” of the property tax wherein taxing capital nationwide does not lower aggregate capital. This leads to the anomaly that Chicago economists favor taxing capital, while dismissing those who would untax capital as “radical” and “confiscatory”. Images, connotations, and associations have trumped meaning and reality.

Modern Marxists have their own way of following Seligman. Untaxing new investing appears to raise investing, they allow, but they hold that this rise is really just borrowing from the future: more today means less tomorrow. Over time, they say, the flow is a fixed “lump”, undiminished by taxation. I will show, rather, that the “lump” is full of yeast and can grow: a) by capital formation, b) by better allocation of capital, c) by import of capital, and especially d) by faster turnover of capital.

The last point, “d”, played a major role in the classical political economy that derived from Turgot and Physiocracy, and preoccupied Marx himself in Book II of Das Kapital, and Keynes in the Treatise on Money, and various Austrian economists over 150 years. Austrians Roger Garrison and Mark Skousen expound it ably today, but many conventional economists today don’t seem to get it. They rather follow J.B. Clark, Frank Knight, and George Stigler, who did their best to bury the idea. In matters of taxation most economists rallied behind the 1986 tax reform where the catchword was “uniformity”. In theory that meant tax all sources of income at the same rate, removing all Walter Heller’s incentives for new investing, even though Ronald Reagan had restored them in his first administration.

In practice 1986 was even worse, it meant sunsetting Heller’s reforms while keeping and expanding most loopholes for land income. For one brief year, “capital gains” were taxed at the same rate as “ordinary” income, but President George H.W. Bush devoted his entire administration to restoring the difference. It was so important to him that he sacrificed many other objectives, including a second term, to achieve a difference of just one percentage point. Why? It was the thin end of a wedge that has now driven the tax rate down to 15% in 2008.

Land value is based at all times on the “opportunity cost” (or best alternative use) of land in its highest future use. The value of this alternative rises by a big factor when future buildings are to be untaxed. The tax relief is tomorrow, but the land value rises today, however sorry and shabby and dated the buildings in place now. This calls for drastic reassessment of land today when future buildings are to be exempted. The effect on revenues is like taxing future buildings before they exist, although they are not to be taxed at all – indeed, BECAUSE they will not be taxed at all. This is the market logic behind what happened in the growing boroughs of New York City in the 1920’s, and caused Clarence Stein to exclaim, “Tax exemption is creating aggregate taxable values to an extent heretofore unknown in the history of any municipality”.

In addition, more compact settlement, a child of the new policy, would create new rents via the synergies that are now aborted by scatter.

The ATCOR tradition in economic thought

What we call ATCOR was central to the thinking of the French économistes of the 18th Century Enlightenment. Economists today, if they are aware of it, refer to it by their name, as the “Physiocratic theory of tax incidence”. Jacob Vanderlint and John Locke preceded the French, who in turn spread the idea widely among the classical political economists.

Adam Smith, a student of Turgot and Quesnay, deplored the “indolence of landowners” that keeps them from seeing the principle, for then they would see that they hurt themselves the most by shunting taxes off land and onto labor, capital, trade, and production. Taxes on useful activity are shifted to rents, he observed, and more: such taxes impose excess burdens that are also shifted to rents (a point we take up next). Other classical economists, with varied emphasis, saw the same points. (For a reservation about Smith’s point, see #12-d, below.)

More recently we find the same insight in works by Paul Douglas, Bronson Cowan, Ebenezer Howard, David Bradford, Dick Netzer, and others[9]. Harold Hotelling and William Vickrey have made much of how lower transit and utility rates are capitalized into higher land values, and a few prominent modern economists like Feldstein and Stiglitz have followed Vickrey in writing on “The Henry George Theorem”. Many other economists, sad to say, spin out their theories innocent of the ATCOR principle and the premises behind it, for they are trained to screen out any thoughts based on distinguishing immobile land from mobile capital.

The muddied waters of modern theory

– Forward shifting of taxes

Many economists have all taxes, like an excise tax, imposed on a sale of a “commodity”. Then it is split between amorphous buyers and sellers. At no point do they distinguish among the factors of production on the “supply curve”. They make land supply as elastic as any other because land can shift among uses. At no point to they face the basic premises of ATCOR, that land is fixed inside any taxing jurisdiction, by definition, while labor and capital in the aggregate are highly elastic.

Richard Musgrave, who trained and swayed so many prominent tax economists of today, applied this model to the property tax on housing[10], as though a property tax on the land in housing is automatically shifted to tenants. It is what Howard Jarvis seized on in 1978 when he promised tenants that lowering property taxes would automatically lower their rents, since property owners, as he put it, do “not pay one cent” in property taxes, but shift them all to tenants. As soon as Prop 13 passed rents shot upwards, and have never looked back (except in the volatile micro-market of cyclical Silicon Valley).

This is one result of displacing production theory by price theory in economic doctrines. In production theory you would assume elastic demand, and focus on the effect on factor proportions (changing productive processes and products, a la Kneese and Bower).

– Making capital stand still

John B. Clark, who devoted much of his career to abusing Henry George, equated capital and land by the device of modeling only a “static” economy in which the supply of capital is fixed, by assumption.[11] He devoted another chunk of his life to chipping away at Eugen von Böhm-Bawerk for the Austrian solecism of focusing on how fast capital turns over. Clark made a point that capital does not turn over at all, thus again helping to erase a difference of capital and land. The meaning for tax policy, driven home by Clark’s colleague and Chair E.R.A. Seligman and by Charles Spahr, is that we should not untax capital while taxing land.

Chicagoan Arnold Harberger disagreed with Musgrave et al., but by an equally fallacious route that he and others modestly called “the new view” of property taxation as they revived Seligman, T.S. Adams, and J.B. Clark. Harberger has the supply of capital fixed, like land, again melding land and capital. This is the Chicago-school position.

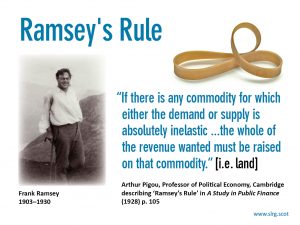

– Abusing the Ramsey Rule

Frank Ramsey, mentored by A.C. Pigou, in 1927 published a Rule for avoiding excess burdens in taxation. The Rule is that taxes should be inversely proportional to elasticities, whether of supply or demand. Putting it positively, taxes should be higher on tax bases that cannot escape the tax. This Rule leads directly to land value as the best tax base. Ramsey, a cautious young academician, left it to his readers to see that point, but and then died young, so there it rests. The point, however, is plain as day[12].

Most of his readers, however, failed him. His Rule has become a standard feature of works on public finance, but the authors leave out the supply side. McLure and Zodrow, for one example of many, cite Ramsey as saying that tax rates should be inversely proportional to demand elasticities[13], never mentioning supply. The result is that many well-read and well-meaning economists believe the Ramsey Rule applies to demand elasticities only.

The rare correct reference is by Joseph Stiglitz, who writes that the “Ramsey tax rate is proportional to the sum of the reciprocals of the elasticities of supply and demand” (emphasis mine)[14]. Some readers’ eyes may glaze over at the verbalized mathematics, but think about this one. Stiglitz mentions both demand and supply. The supply elasticity of land is zero; the reciprocal is infinity. So the Rule leads us right to an infinite (or very high) tax rate on land.

Consistently, Stiglitz adds that “… the burden of the tax on capital is not felt, in the long run, by the owners of capital. It is felt by land and labor. … in the long run, workers will emigrate … this leaves land as the only factor that cannot emigrate … the full burden of the tax is borne by land owners in the long run.” “While a direct tax on land is nondistortionary, all the other ways of raising revenue induce distortions.”[15]

The Rule goes on that nothing should be taxed at all if there is an alternative tax base whose supply or demand is more inelastic. Here is A.C. Pigou, Ramsey’s tutor:

“By analogous reasoning it can be shown that, when one source of production yields an absolutely inelastic supply, … a given revenue can be raised with less sacrifice by concentrating taxation upon this use than by imposing uniform rates of tax on all uses”. “If there is any commodity for which either the demand or the supply is absolutely inelastic, the formula implies that the rate of tax imposed on every other commodity must be nil, i.e. that the whole of the revenue wanted must be raised on that commodity.”[16]

Allyn Young, reviewing Pigou in 1929, quotes him that tax rates should “become progressively higher as we pass from uses of very elastic demand OR SUPPLY (emphasis mine) to uses where demand OR SUPPLY (emphasis mine) are progressively less elastic.” Young continues, “This suggestion is joined (by Pigou) to Mr. Ramsey’s findings[17]. Allyn Young, unlike modern text writers, had no problem understanding Ramsey and Pigou and citing them straight.

It appears that Pigou and Ramsey were willing to follow their predecessor Alfred Marshall and endorse the ideas of Henry George, provided they could do so in a suitably obscure and indirect academic way[18], not mentioning George, and avoiding all the slings and arrows their colleagues, and Marshall himself, had once directed at George ad hominem.

What about zero demand elasticities (vertical demand curves)? Are there such things? If there were, each one would make an infinite tax base. It would mean that we could raise tax rates to the blue sky, and buyers would not slack their purchases but pay whatever the seller charged. Obviously that cannot be. Vertical demand curves are conceivable within short reaches of a demand curve. Above that, high prices cut demand by impoverishing buyers. In Economese this is an income effect. That is, a high tax taken from a buyer lowers her real income (and wealth and liquidity, too) so that even if she is a, say, drug addict, buying compulsively at any price, she is soon broke.

Summary on ATCOR

The revenue capacity of land, when it is substituted for other tax bases, is comparable to current revenues. Owing to efficiency effects, and renewal effects, it is actually higher, as shown next in Element #12. The major reservation is that the supply of labor is not totally elastic, so some of the revenue gains may be “lost” in higher wage rates, but on the whole higher wage rates are socially desirable, and serve to lower many public costs as for welfare, policing and jailing, aggressive military spending, make-work projects, etc.

[1] U’Ren was the father of the “Oregon System” of Initiative, Recall, and Referendum, a system he pushed to further his ultimate aim of moving Oregon to the single tax. He succeeded in the former, making him a great power in Oregon and even national politics. He failed to boost the latter quite over the top, but by making the effort he won many concessions like making tax assessors put higher taxable values on land.

[2] Gaffney, Mason, 2005. New Life in Old Cities. New York: the Robert Schalkenbach Foundation; and Gaffney, Mason, 1971. “Adequacy of Land as a Tax Base”, in Daniel Holland (ed.), The Assessment of Land Value, Madison: University of Wisconsin Press.

[3] 1915, For the Committee on Taxation of the City of New York Publisher New York : [s.n.], 1915 (New York : M.B. Brown, Printing)

[4] 3-14-24 report of the (Clarence) Stein Committee, cited in Pleydell, Albert, and Elizabeth Wood, 1960. How Tax Exemption Broke the Housing Deadlock in New York City. New York: Citizens’ Housing and Planning Council of New York, Inc. (CHPC), Appendix p.23

[5] BW 6 March 95. David Card and Alan B. Krueger say otherwise. Becker cites studies saying it is so, by Donald Deere and Finis Welch, TX A&M; Kevin Murphy, U of Chicago. Papers at Jan AEA mtgs.

[6] George, 1879, Progress and Poverty, pp. 248-49

[7] George recognized this, although he had his own clumsy indirect way of expressing it. He did not regard consumer capital as being “really” capital, but he did observe people living on it while they produced other capital.

[8] Seligman, 1895, Chap. III, §4, repeated through 10 editions

[9] These works are cited in Gaffney, 1972

[10] Musgrave, Richard, et al., 1951, “Distribution of Tax Payments by Income Groups: A Case Study for 1948,” IV, National Tax Journal (1) : 1-53, March, 1951. For a list of others see Dick Netzer, Economics of the Property Tax (Washington, D.C., Brookings Institution, 1966), pp. 247 ff., and the Netzer book itself, Chap. III.

[11] For extended documentation of Clark’s vendetta against George, see Gaffney, 1994-A, pp.47-59

[12]Ramsey, Frank, 1927. “A Contribution to the Theory of Taxation.” EJ 37:47-61.

[13] McLure, Chas. Jr., and George R. Zodrow, 1994. “The Study and Practice of Income Tax Policy.” In John Quigley and Eugene Smolensky (eds.), Modern Public Finance. Cambridge: Harvard University Press, p. 186

[14] Stiglitz, Joseph, 1986. Economics of the Public Sector. NY: W.W. Norton & Company,

pp.403-04.

[15] Op. cit., pp. 567-68

[16] A.C. Pigou (orig. 1928) A Study in Public Finance. 3rd Ed., 1947, rpt. 1949. London: Macmillan & Co. Ltd., p. 105

[17] Allyn Young, 1929, Review of A.C. Pigou: a Study in Public Finance, 1928. EJ XXXIX, March, p. 15. Rpt in Musgrave & Peacock, Readings in the Economics of Taxation, 1959 (Irwin) pp.13-18

[18] For Marshall’s endorsement see Gaffney, Mason, 2004-, “A Cannan Finds the Mark”, last 4 paragraphs.

________________________

Excerpt from “The Hidden Taxable Capacity of Land”, Mason Gaffney, 2009, International Journal of Social Economics 36(4):328-411, pp. 370-76.